Can these popular TV characters afford their homes in real life?

Warner Bros. Television // Getty Images

Can these popular TV characters afford their homes?

Your favorite sitcom characters may be giving you unrealistic living expectations.

Sitcoms make us laugh with outlandish yet realistic scenarios that we can all relate to on some level. But what’s unrealistic is how some of these characters can afford incredibly spacious living quarters — especially with many of them living in expensive cities and working jobs with less-than-ideal salary ranges.

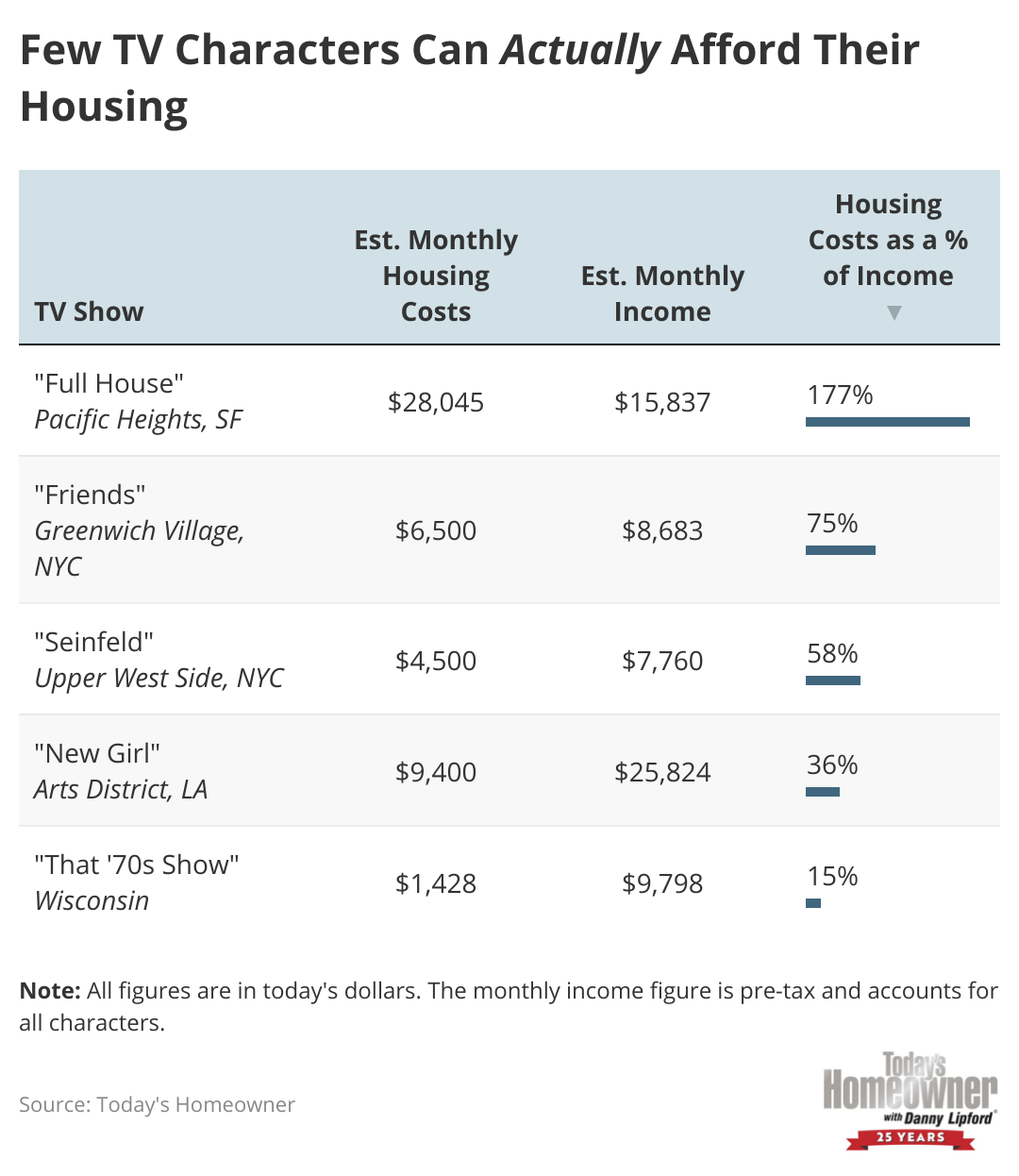

The Today’s Homeowner research team used real-life data to discover how much fictional homes would cost in 2023 and how those costs compare to monthly income of the tenants. They analyzed data from five TV shows where the homes are front and center: “Full House,” “Friends,” “Seinfeld,” “New Girl,” and “That ’70s Show.”

These successful sitcoms spent years on the air, and many characters had career changes throughout the show. To keep things consistent, the study considered the income for the character’s jobs as of season 1 unless otherwise noted. It used the most up-to-date housing and salary data based on recent averages.

Today’s Homeowner

Main Findings

- “Full House” is the show with the most unrealistic living situation. The study estimates that today their monthly housing costs would make up a whopping 177% of the character’s estimated household income. The estimated monthly mortgage payment is roughly $28,000 and their pre-tax pay stands at less than $15,900.

- Across the five shows analyzed, the characters would not be housing cost burdened in only one: “That ’70s Show.” In all four other shows, housing costs make up more than 30% of income, which is the threshold for being considered “housing cost burdened,” according to the U.S. Department of Housing and Urban Development (HUD).

- Schmidt carries the team in “New Girl.” “New Girl” ranks as the second-most realistic show when it comes to housing affordability, with housing costs making up about 36% of income. However, if the rent was split evenly between the four friends, $2,350 a month would be way out of budget for Nick and Jess and a bit of a stretch for Winston, too.

Carlos Avila Gonzalez/San Francisco Chronicle via Getty Images

‘Full House’ House

- House location: Lower Pacific Heights, San Francisco

- House size: 4 bedrooms, 3,700 square feet

- Est. monthly household income: $15,837

- Est. monthly housing costs: $28,045

- Housing costs as a percentage of income: 177%

The theme song asks, “Whatever happened to predictability?” But when it comes to affording the “Full House” house, the better question may be, whatever happened to practicality?

Even three adult incomes are no match for this iconic four-bedroom, three-and-a-half-bathroom home. Danny, Uncle Jesse, and Joey would likely need second jobs to afford the $5.5M Victorian and financially support three daughters.

The beloved ’80s and ’90s sitcom “Full House” centered around an unconventional family living in the posh neighborhood of Lower Pacific Heights, San Francisco. It featured a widowed father, Danny Tanner, raising his three daughters alongside brother-in-law Jesse Katsopolis (“Uncle Jesse”) and childhood best friend Joey Gladstone.

With three adults contributing to housing costs, you might think the living situation seems reasonable. But the incomes of each of the men paint a different picture. Danny is a news anchor with an estimated annual salary of $85,000 in San Francisco. Jesse and Joey run a radio station, and disc jockeys in the area have an estimated annual salary of about $52,520. That leads to a combined annual income of $190,040.

The Tanner clan is bringing in $15,837 per month, which is a drop in the bucket for where they live. The 3,728-square-foot Victorian home at 1709 Broderick St. sold for $5.35M in 2020, according to Zillow. That would put their monthly housing expenses around $28,045, assuming a mortgage rate of 5.7%, which would mean 177% of their income would be needed for housing costs alone. Not to mention they have three kids to care for, too.

What if we skip to season 2 and add the fourth income of Danny’s co-anchor and Jesse’s wife, Rebecca Donaldson (Aunt Becky)? Even with her additional $85,000 a year, monthly housing costs would still be 122% of their combined income.

In conclusion, either the “Full House” family was full-y in debt, or the Tanners had some unmentioned inheritance. Or perhaps Danny Tanner spent his life saving up for a hefty downpayment and got an extraordinarily low mortgage rate.

‘Friends’ Apartment

- Apartment location: Greenwich Village, NYC

- Apartment size: 2 bedrooms, 1,500 square feet

- Est. monthly household income: $8,683

- Est. monthly housing costs: $6,500

- Housing costs as a percentage of income: 75%

The “Friends” NYC apartment is perhaps the most unrealistic physical space across TV shows, as a 1,500-square-foot apartment in Greenwich Village is virtually unheard of. NYC apartment rents can vary widely in cost, but if this iconic purple abode were real, we estimate it would rent for around $6,500 in 2023.

Considering Monica’s and Rachel’s annual incomes for their season 1 jobs as a chef ($64,190) and a waitress ($40,000), they’d have a combined monthly pre-tax income of $8,683 — a whopping 75% of their monthly income going toward rent. In real life, these women would need to PIVOT to something more affordable.

The popular series “Friends” is about a group of 20-somethings who — as the theme song suggests — are broke and have jobs that are jokes. The comedic relatability of their messy lives is part of the reason the show has stayed popular for nearly 30 years.

But what’s not relatable is the massive NYC apartment that Monica Geller and Rachel Green live in, despite being “broke.”

Whether you’re a fan of the show or not, you’ve likely seen the legendary purple-walled apartment on 90 Bedford St. With its two bedrooms, large open-concept kitchen and living room area, and balcony, the apartment is estimated to be 1,500 square feet. If it did exist, an apartment of that size in Greenwich Village would probably cost around $6,500 per month (or more) in 2023.

The idea that Monica and Rachel could afford to live here is so unrealistic that the show’s writers had to explain that the large apartment was left to Monica after her grandmother passed and was rent controlled for $200 per month.

‘Seinfeld’ Apartment

- Apartment location: Upper West Side, NYC

- Apartment size: 1 bedroom, 800 square feet

- Est. monthly household income: $7,760

- Est. monthly housing costs: $4,500

- Housing costs as a percentage of income: 58%

Jerry Seinfeld’s Upper West Side apartment on 129 W. 81st St. is a one-bedroom apartment with an open-concept kitchen and living room, estimated to be roughly 800 square feet. The bachelor pad would likely cost the comedian $4,500 in rent in 2023, more than half (58%) of his estimated monthly income of $7,760.

It’s hard to believe Jerry could afford to live in this apartment and meet his pals at Monk’s Cafe every day.

If there were ever a battle for the most famous fictional NYC apartment, “Friends” and “Seinfeld” would duke it out. Jerry Seinfeld’s gray walls, pale blue couch, and corner kitchen was like a second home for the many Americans watching the show throughout its nine-season run in the ’90s. You can practically hear the audience cheer just thinking about Kramer sliding through that front door.

Jerry’s Upper West Side apartment on W. 81st St. was likely out of his price range. The one-bedroom, 800-square-foot space featured a small kitchen and open-concept living room. In 2023, the study estimates an apartment like this would rent for around $4,500, which is more than half (58%) of Jerry’s estimated monthly income of $7,760 on a comedian’s salary.

While Jerry’s living situation may be slightly more realistic compared to the “Friends” women, he’d probably still have a hard time affording his rent and all those meals and coffees at Monk’s Cafe.

‘New Girl’ Apartment

- Apartment location: Arts District, Los Angeles

- Apartment size: 4 bedrooms, 2,600 square feet

- Est. monthly household income: $25,824

- Est. monthly housing costs: $9,400

- Housing costs as a percentage of income: 36%

An affordable, warehouse-style L.A. loft spacious enough to play “True American” may be too good to be true, especially with two of the four roommates on a teacher’s and bartender’s salary. The 2,600-square-foot apartment would likely cost $9,400 in 2023. It’s no wonder Nick refuses to pay for the “weefee” (WiFi), as he probably can’t afford to.

When “New Girl” rose to popularity on streaming services in 2013, it was dubbed by many as the modern-day “Friends.” The large, industrial-style loft and its lovable tenants have fans dreaming of becoming a fifth roommate, even if it means sharing a single bathroom.

As it turns out, the “New Girl” crew could benefit from a fifth roommate, because this apartment would be a bit out of their budget.

The building used for exterior shots in the show is a real apartment and office building called the Binford Lofts, located on 837 Traction Ave in the Los Angeles. What’s not real is the 2,600-square-foot, four-bedroom apartment where roommates Jess, Nick, Schmidt, and Winston have ample space to play “True American” (which, if you haven’t seen the show, involves an obstacle course).

In reality, the Binford Lofts only offers studio apartments and office spaces. But based on median costs for the neighborhood, a 2,600-square-foot apartment in the Los Angeles Arts District would cost around $9,400 per month.

Let’s look at the four roommates and their estimated salaries. Jessica Day is a school teacher ($66,669 annually), Nick Miller is a bartender ($42,217 annually), and Winston Schmidt is a marketing manager ($121,000 annually). Winston Bishop has multiple temp jobs throughout the show, but to keep things simple, the study used his police detective salary ($80,000). Tallied up, the “New Girl” gang rakes in $25,824 per month, meaning their loft would be a combined 36% of their monthly income.

The “New Girl” characters are not severely housing cost burdened, which is defined as spending 50% or more of your income on housing costs. However, if the rent is split evenly between the four friends, $2,350 a month would be way out of budget for Nick and Jess, and a bit of a financial stretch for Winston, too.

‘That ’70s Show’ House

- House location: Wisconsin

- House size: 3 bedrooms, 3,100 square feet

- Est. monthly household income: $9,798

- Est. monthly housing costs: $1,786

- Monthly housing costs as a percentage of income: 18%

Red Forman is known for being frugal, so it only makes sense that the Formans are all right financially. The three-bedroom suburban home in Wisconsin would cost an estimated $1,786 per month. With Red working at an auto plant and Kitty as a nurse, just 18% of their monthly income goes toward housing.

Hello, financial responsibility!

“That ’70s Show” is centered around six teenage friends living in the fictional town of Point Place, Wisconsin. The crew can mostly be found hanging out in the home of Red and Kitty Forman, a three-bedroom, two-and-a-half bathroom home with a furnished (and often hazy) basement.

Based on housing cost averages in Wisconsin, the Formans’ 3,100-square-foot home would likely cost $272,500, or $1,786 per month. At the beginning of the series, Red works at a local auto part plant, earning an estimated $40,720 per year in 2023 dollars. His wife Kitty is a nurse, making $76,850 annually.

With a monthly household income of $9,798, the Formans spend roughly 18% of their monthly income on rent. With Red Forman being a lifelong blue-collar worker and war veteran, it’s no surprise his strict discipline extends to the family’s financial responsibility.

Methodology

The study used real-world rent and home cost data from various market resources, including apartments.com, Zumper, and Redfin, to determine housing costs for these fictional TV homes.

Researchers then found median salary information from BLS data reflecting what each character would be earning today, taking location into account. After gathering data on monthly housing costs and combined monthly salaries for all household members, they determined how much each household would spend on housing.

This story was produced by Today’s Homeowner and reviewed and distributed by Stacker Media.

Written by: Kristina Zagame